Investing in a Junior ISA can be a great way for parents to put money away for their children. Within this type of investment account, all capital gains and dividends are completely tax-free. And parents can invest up to £9,000 per year for each child.

One challenge with this type of ISA however is choosing the best investments. Those putting money aside for their children and grandchildren in a Junior ISA generally have a very long time horizon in which to invest. So what’s the best approach to investing?

The best investment for a Junior ISA?

Personally, if I was investing in a Junior ISA for my child today, I’d be focusing heavily on the technology sector. The reason is that we’re in the midst of a technology revolution that looks set to last for years, if not decades. Given this backdrop, I think tech stocks are likely to generate strong returns in the next decade and beyond.

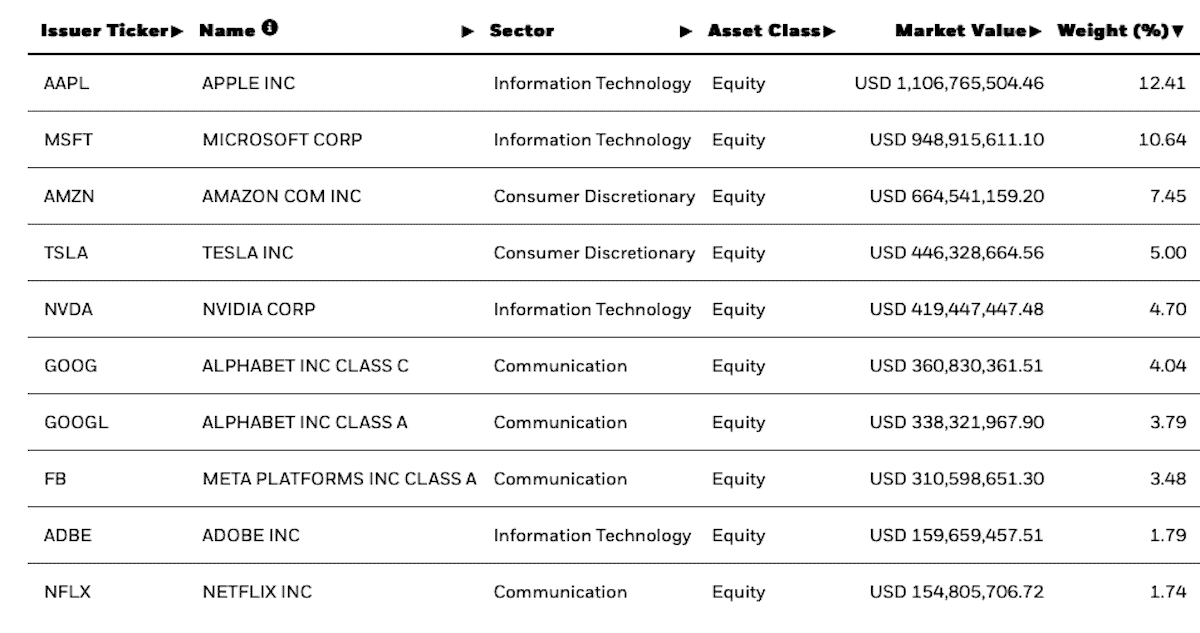

One easy way to get broad exposure to tech stocks is through a NASDAQ 100 tracker fund such as the iShares NASDAQ 100 UCITS ETF. This is a technology-focused index that’s made up of the 100 largest non-financial companies listed on the NASDAQ Stock Exchange. One of the world’s preeminent large-cap growth indexes, it contains an attractive mix of technology companies that are driving the tech revolution and look set for strong growth in the years ahead.

The world’s best tech stocks

One thing I like about the NASDAQ 100 is that it contains both mega-cap tech stocks and smaller, more under-the-radar names. This means that it provides exposure to companies that are dominant today, as well as those that could be the giants of tomorrow.

The largest holdings in the index are Apple, Microsoft, Amazon, and Alphabet (Google). These companies are already enormous. However, I think there’s plenty of growth to come from them in the years ahead. Looking further down the list of index constituents, there are a number of exciting, high-growth companies that could turn out to be tomorrow’s heroes:

-

Nvidia – which looks set to power the artificial intelligence revolution and the metaverse with its high-power computing technology

-

Intuitive Surgical – a leader in the robotic surgery space

-

CrowdStrike – one of the biggest cybersecurity companies in the world

-

Zoom Video Communications – the leader in video conferencing technology

NASDAQ 100 Top 10 Holdings

Source: iShares. Data: 16 December 2021

Another attractive feature of this index is that it’s ‘self-cleansing’. What I mean by this is that if a company becomes obsolete, it’s likely to be removed from the index. Similarly, if a company becomes more dominant, its weight in the index is likely to increase. This means that no matter what happens in the technology space in the years ahead, investors in this index should be able to capitalise on the growth of the industry.

Risks

Of course, there are risks here. If technology stocks crash (as they quite often do in the short term), this index is likely to underperform. Similarly, if the US market falls, this index could struggle. I’d want to have other investments in my child’s Junior ISA for diversification.

Overall however, I think the NASDAQ 100 is a top index for long-term growth. That’s why I’d invest in it via an ETF within a Junior ISA.