Tesla’s big share price gains have been making the headlines recently. However, there are other electric vehicle (EV) stocks that have been generating monster returns for investors recently as well. Lucid Motors (NASDAQ: LCID), which went public in late July via a SPAC deal, is one such stock. Over the last month, its share price has risen more than 50%.

Is Lucid a stock I should consider for my own investment portfolio? Let’s take a look at the investment case.

Lucid stock: the bull case

When I look at Lucid Motors from an investment point of view, two things stand out to me. One is that the company – which is led by former Tesla engineer Peter Rawlinson – has some very nice products.

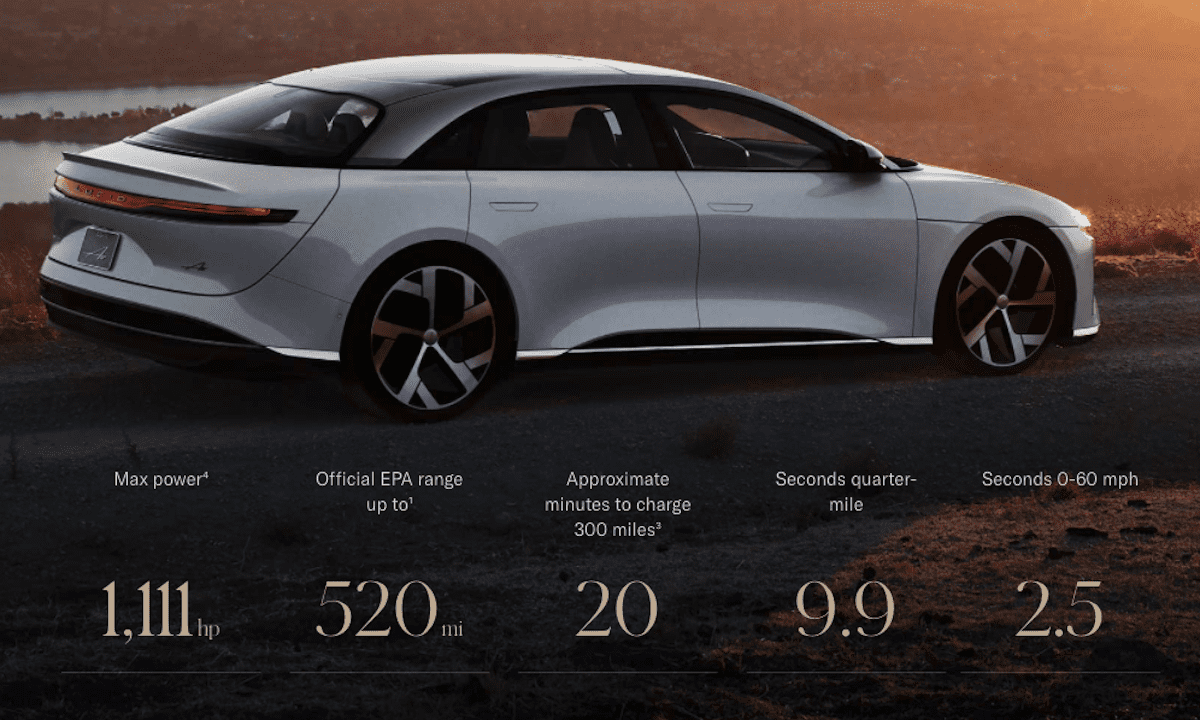

Take its flagship EV, the Air, for example. This model, which Lucid describes as the ‘the quickest, longest-range, fastest-charging luxury electric car in the world’ can go from 0-60mph in just 2.5 seconds. Meanwhile, it has a huge range of 520 miles, which is far superior to that of Tesla EVs.

Given its specs, the Lucid Air could potentially be a genuine threat to Tesla and its Model S Plaid. It’s worth noting that in October last year, Tesla cut the price of its Model S, shortly after Lucid announced the pricing of its base model. “The gauntlet has been thrown down,” tweeted CEO Elon Musk at the time.

Source: Lucid Motors

Another thing that stands out to me about Lucid is that its cars are already in production. With some EV companies, commercial production is still years away. However, this isn’t the case here. Already, customers are receiving deliveries of their Air vehicles. And the company aims to ramp up production at its Arizona plant to 90,000 vehicles per annum within the next two years.

Analysts at research firm CFRA – who have a $50 share price target for LCID stock – point out that because Lucid is targeting the luxury market (the Air starts from $77k), it will need to sell less vehicles than other EV manufacturers to achieve profitability.

Is Lucid’s share price too high?

One concern I have here, however, is Lucid’s valuation. At the current share price of $37, the company has a market capitalisation of $59bn. That’s high. To put that in perspective, Ford, which sold about 4.2m cars last year and has recently launched some hot new EV models, has a market-cap of $72bn.

Meanwhile, the stock’s forward-looking price-to-sales ratio (using next year’s estimated sales) is about 34. By contrast, Tesla’s forward-looking price-to-sales ratio is about 17.

It’s worth noting here that Morgan Stanley analyst Adam Jonas, who covers EV stocks, has a price target of $12 for Lucid. That’s nearly 70% below the current share price. Jonas believes Lucid has a long way to go before it can be compared to Tesla.

Should I buy Lucid stock today?

Weighing everything up, I’m happy to leave Lucid Motors on my watchlist for now. I think there are better growth stocks I could buy at the moment.