Yesterday, financial technology (FinTech) company Wise (LSE: WISE), which was formerly known as TransferWise, listed directly on the London Stock Exchange. The event represented London’s largest-ever tech listing.

I’m very bullish on the FinTech sector as a whole and I also think Wise offers a brilliant service. So, should I buy its shares? Let’s take a look at the investment case.

Wise: the business

Wise operates a global cross-border payments network that enables people to send money around the world quickly and cheaply. The company was founded in 2011 by two Estonian friends who, frustrated by high money transfer fees and poor exchange rates offered by banks, decided to create a more efficient, cost-effective way for people to transfer money.

Today, Wise has over 10m customers who send more than £5bn every day across its platform (saving £3m in bank fees!). Individuals use the platform to send money across borders and spend money in different currencies while businesses use the platform to expand globally.

Wise shares began trading at £8, valuing the company at £8bn. However, the share price has risen since the listing.

Wise shares: the bull case

There are a number of things I like about Wise from an investment point of view. For starters, the company offers a fantastic service. I’ve used its platform to send money internationally since its early days and I’ve always been very impressed. The platform is incredibly easy to use and payments are very fast. And I’m not the only one who likes it. On Trustpilot, Wise has a score of 4.6 out of 5 and a rating of ‘excellent’.

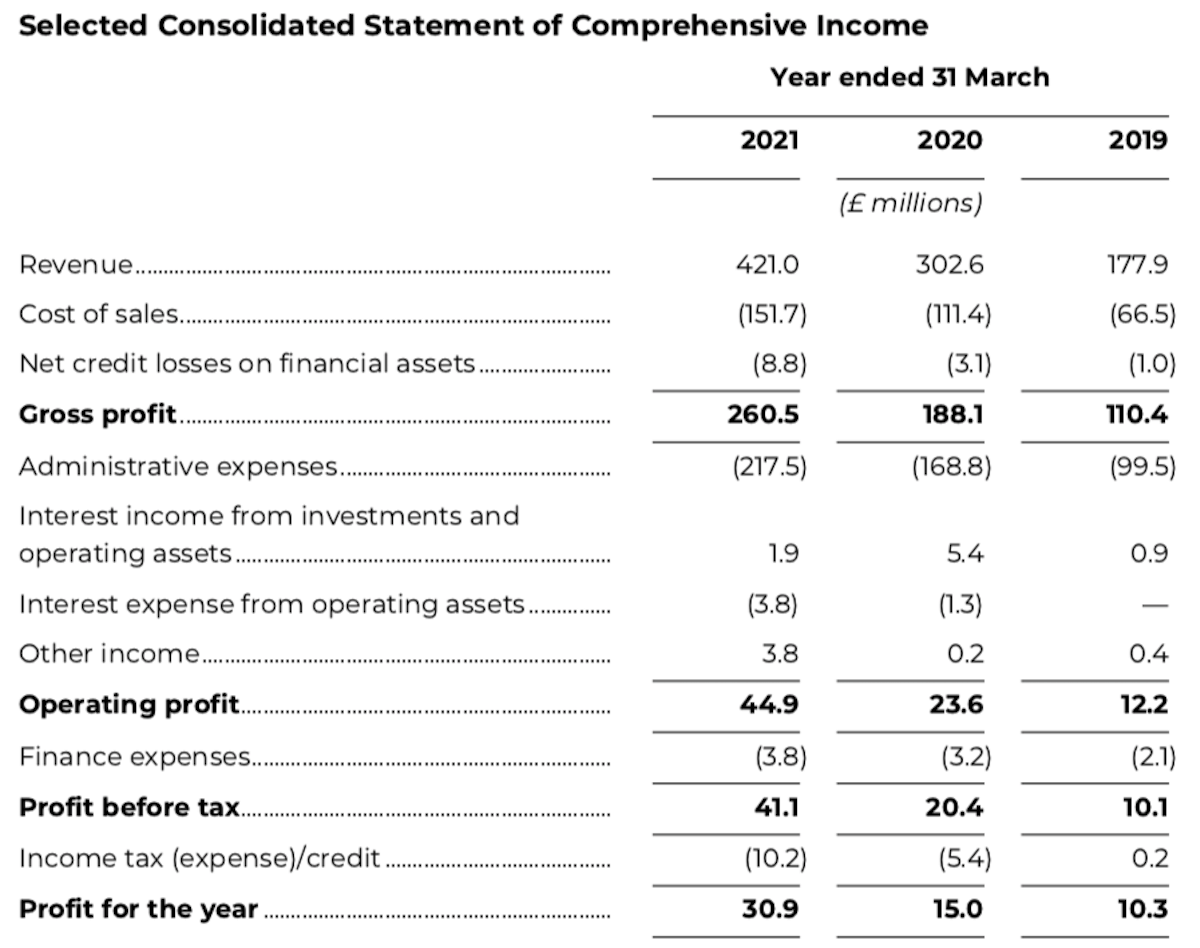

Secondly, the company is generating impressive revenue growth. Between FY2019 and FY2021 (its financial year ends 31 March), revenue climbed from £178m to £421m. That represents annualised growth of 54%.

Source: Wise

Third, unlike many other young technology companies, Wise is profitable. Last year, it generated earnings of £30.9m. This reduces risk significantly.

Finally, Baillie Gifford is a major shareholder and owns around 5% of the shares. This is encouraging. Baillie Gifford is one of the best in the business when it comes to investing in disruptive growth companies.

Risks

But there are risks to consider here. My main concern is competition. Are there big barriers to entry in this industry? I’m not sure. Could another FinTech company offer a similar service and capture market share? Possibly. In its prospectus, Wise said: “There may be other companies who create better products and services for our customers in the future.”

Another concern is in relation to the direct listing. With this type of listing, insiders aren’t obliged to hold on to their stock for a certain period of time like they are with an Initial Public Offering (IPO). If insiders decide to dump a lot of stock, it could put pressure on the share price.

There’s also the valuation. Currently, Wise sports a trailing price-to-sales ratio of a little over 19. That’s quite high. PayPal, which I consider to be the leader in the FinTech space, trades on 16. This high valuation also increases risk.

Should I buy Wise shares?

Weighing everything up, I’m going to keep Wise shares on my watchlist for now. The company certainly looks interesting. However, the valuation is a bit high for me at present.