Witan Investment Trust (LSE: WTAN) is a popular investment at the moment. Last week, the trust was the third most purchased stock on Hargreaves Lansdown‘s investment platform.

Is this a trust I should consider for my own portfolio? I’m taking a look at the investment case.

Witan Investment Trust: investment strategy

Witan’s Investment Trust is a global equity product that seeks to construct a diversified portfolio covering a broad range of markets and sectors. Its aim is to offer a distinctive way for investors to access the opportunities created by global economic growth. Its benchmark is a composite of 85% global equities (MSCI All Country World Index) and 15% UK equities (MSCI UK IMI Index).

Multi-manager approach

What’s unique about Witan is that it employs an ‘multi-manager’ approach, with its capital managed by selected managers with different styles and specialisations. It selects what it considers to be ‘exceptional’ third-party managers who are expected to outperform their assigned benchmarks. Most of these managers are not available for investment by UK individuals.

One example of a manager that Witan uses is star fund manager Nick Train. He currently manages around 14% of the trust’s assets. Each different manager has their own style, which means that the trust is quite diversified in its approach.

Portfolio breakdown

Looking at the holdings, the trust certainly has an interesting composition.

The top 20 holdings include a climate change fund, a mining trust, and multiple private equity funds. There’s also a mix of tech stocks such as Alphabet and MercadoLibre and consumer goods stocks such as Unilever and Diageo.

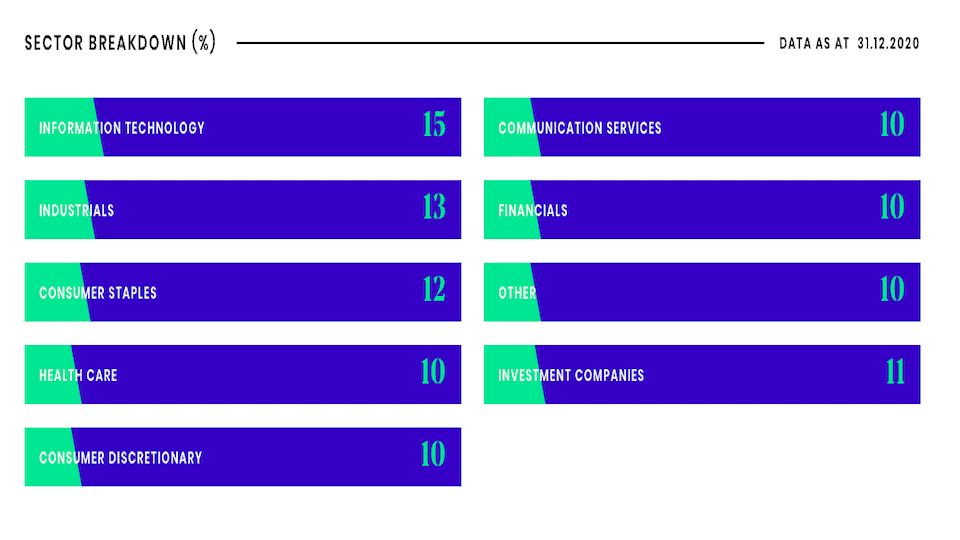

Sector wise, the trust is quite diversified. It’s not heavily exposed to the technology sector like some other global equity trusts are.

Source: Witan Investment Trust. Data as of 31/12/2020.

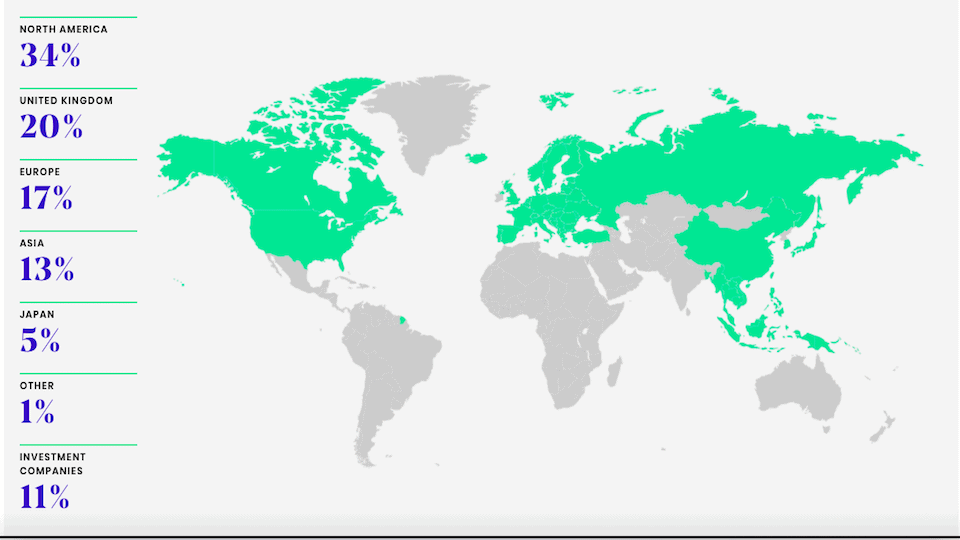

Geography wise, the trust has over half its assets in the US and the UK.

Source: Witan Investment Trust. Data as of 31/12/2020.

Performance

Over the last five years, Witan’s net asset value (NAV) has risen 69.5%. That equates to an annualised return of about 11.1%.

That’s a solid return. However, it is below its benchmark, which has increased 74%. It’s also well below a lot of other global investment trusts. For example, Monks Investment Trust, which I listed as one of my top investment trust picks for 2021, delivered a NAV increase of 174% over the same period.

Fees

In terms of fees, this trust isn’t so cheap. Ongoing charges are 0.79% per year excluding the performance fee. With the performance fee, fees rise to 0.87%. Monks, by contrast, offers a fee of 0.48%.

My view on Witan Investment Trust

Having taken a closer look at Witan Investment Trust, I can say that it’s not a trust I’d personally invest in. There are three main reasons why.

Firstly, the investment strategy is too mixed for me. I prefer funds and trusts that offer a clear strategy. Smithson is a good example of one such trust.

Secondly, the performance has been underwhelming. A 70% return for a global portfolio over the last five years is not brilliant.

Third, fees are quite high, given the performance.

All things considered, I think there are better trusts to invest in right now.