Snowflake (NYSE: SNOW) shares are on fire right now. In the last month, the stock – which is owned by Warren Buffett – has risen from around $240 to $371. That represents a gain of more than 50%.

Is this a growth stock I should buy for my ISA? Let’s take a look at the investment case.

Snowflake: what does it do?

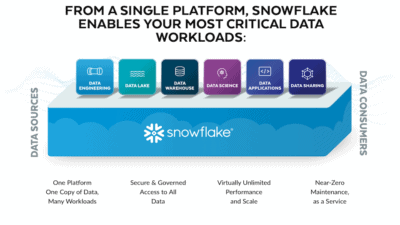

Snowflake is a US technology company that provides cloud-based data storage and analytics services. Its platform, which has been designed to harness the immense power of the cloud, offers:

-

Low-cost cloud storage

-

Quick and easy access to data

-

High-level data security

-

Fast, intuitive analytics

-

A managed-service solution

Source: Snowflake

Currently, Snowflake has over 3,500 customers including financial services firms, healthcare companies, retail businesses, and governments. Some 65 of these are ‘$1m+’ customers.

SNOW operates in a high-growth industry. According to Grandview Research, the global cloud computing market – which was valued at $266bn in 2019 – is expected to expand at a compound annual growth rate (CAGR) of 14.9% from 2020 to 2027. This strong industry growth should provide tailwinds for the company.

Financials: strong revenue growth

Snowflake certainly appears to have a lot of momentum right now. In its recent third-quarter results, product revenue came in at $148.5m, 115% higher than the same period in the previous year. Remaining performance obligations – which is deferred revenue plus the backlog – was up 240% year-on-year.

“The period was marked by continued strong revenue growth coupled with improving unit economics, cash flow, and operating efficiencies. Our vision of the Snowflake Data Cloud mobilizing the world’s data is clearly resonating across our customer base,” commented CEO Frank Slootman.

It’s worth pointing out however, that the company was not profitable in Q3. For the quarter, the company generated a Non-GAAP operating loss of $48.1m. This adds risk to the investment case.

Looking ahead, Snowflake said it expects full-year product revenue of $538m-$543m, which would represent growth of 113-115%.

Is SNOW cheap?

Turning to the valuation, this is a stock that isn’t cheap. After the amazing share price rise in the last month, Snowflake now sports a market capitalisation of $105bn. That’s high.

Taking the mid-point of this year’s revenue forecast, the price-to-sales ratio is an eye-watering 194. Even if we look ahead to next year and use the consensus revenue forecast of $1.09bn, the price-to-sales ratio is still close to 100.

These valuations are way too high for my liking. Amazon, which is the largest player in the cloud industry, can be picked up right now on a price-to-sales ratio of about four.

Should I buy Snowflake stock?

All things considered, I think Snowflake looks like an interesting stock. Its growth is certainly impressive. However, after the recent share price spike, the valuation is too elevated for my liking. For this reason, I’m going to keep SNOW on my watchlist for now.

All things considered, I think there are better stocks to buy at the moment.