Operating a mining business is a difficult feat. Besides the massive costs of setting up a site, there is a plethora of regulatory restrictions surrounding safety, maintenance of equipment, and logistics that add to operational expenses. Yet I believe this high-yielding dividend stock – around 9% at current levels – can avoid all these complications while still obtaining extracted resources.

Unlike a traditional mining company, Anglo Pacific Group (LSE:APF) does not operate any mining sites. Instead, it provides funding for other mining companies – including Rio Tinto and BHP Group– to develop or expand extraction sites.

In exchange, Anglo Pacific receives a portion of the minerals dug up during the site’s active life as a form of royalty payment.

Since the company is not directly involved with operating any of the mines, its operational expenses are near non-existent, resulting in operating profit margins of nearly 80%!

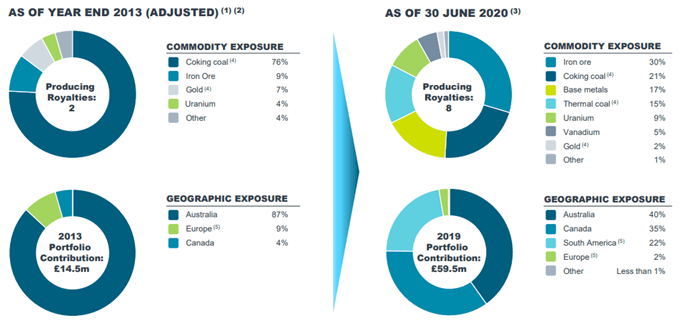

As of June 2020, the high-yielding dividend stock has 15 sites within its portfolio, eight of which are mature producers, four in early-stage, and three in development. They’re also geographically diversified around the world, giving exposure to a wide range of commodities as well.

The ever-expanding portfolio combined with a low operating cost business model is the driving force behind the firm’s average 41% growth in revenue, 58% growth in operating profits, and 17% growth in shareholder dividends over the last four years.

|

£m |

2019 |

2018 |

2017 |

2016 |

Avg. Year-On-Year Growth (%) |

|

Revenue |

56 |

46 |

40 |

20 |

41 |

|

Operating Profit |

43 |

35 |

30 |

11 |

58 |

|

Gross Dividend |

16 |

18 |

13 |

10 |

17 |

Despite the incredible performance, the share price of this high-yielding dividend stock has dropped by nearly 50% since January 2020.

Covid-19 has caused a large number of disruptions across many industries, and mining is no exception. Due to the closure of multiple sites throughout March, the firm’s performance is likely to drop significantly for 2020 as a whole. This, combined with the drop coal prices – a commodity that comprises 36% of Anglo Pacific’s portfolio – explains the selloff.

However, the majority of the sites are now back in operation, with management expecting full operations will be back up and running by Q3 of 2020.

The factory shutdowns in China that created the sharp decline in coal prices have also come back online, leading to a steadily recovering commodity price.

Long-term the demand for coal is set to decline as more western countries begin switching to renewable energy generation. The management team of this high-yielding dividend stock is fully aware of this and have been actively increasing their investments in more long-lived commodities.

Back in 2013, coal represented nearly 76% of the overall portfolio. Today it’s closer to 36% and is continuing its downward trend. At the same time, other materials, such as iron ore and other base metals, take its place.

The catalyst behind the decline in share price is ultimately a short-term problem. I believe the overreaction from investors has allowed Anglo Pacific to become vastly undervalued, given its long-term potential. With no cut to 2020’s dividend, investors can now take advantage of a 9% yield on a stock that I believe will further appreciate in share price as well.