I’ve been looking at covering Supply@me Capital (LSE:SYME) for a while, but couldn’t get my head round it. With billionaire Warren Buffett’s advice ringing in my ears: “Invest in what you know”, I thought if I can’t even get to grips with what this company does, it’s probably a warning to steer clear. However, with the SYME share price sliding after a significant rise, it’s again piqued my interest. I delved deeper to get a clearer understanding of what it’s about and whether it’s a good UK share to buy.

Inventory monetisation

- It’s a fintech firm, meaning it utilises technology to offer a financial solution to businesses.

- It’s giving companies an opportunity to make money from their inventory.

- This inventory monetisation provides investors with a new asset class.

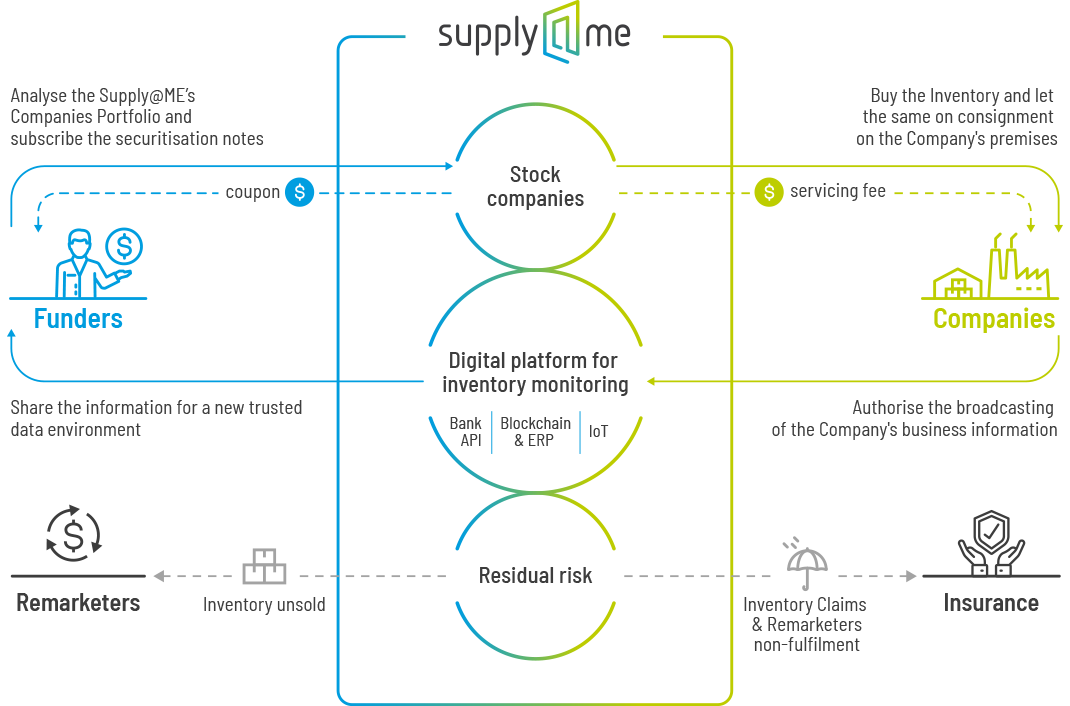

Combining these points, we come to the crux of the company. Supply@Me has created a unique trading platform (the tech in fintech) giving manufacturing and trading businesses a chance to improve their working capital (the fin). At the same time, it provides investors with an exciting new area to get involved in.

Putting inventory to work

Rather than be left with masses of unsold inventory sitting on company shelves, this platform gives companies a chance to generate cash flow from their unsold goods. The company can digitally add its inventory to the Supply@Me platform. In return it gets certificates corresponding to the size of its digital allocation. The company then exchanges the certificates for cash from Supply@Me. The company can use this cash to keep its business ticking over. Meanwhile, if it sells the inventory, it buys back the certificates, removing its goods from the platform.

Supply@Me uses a private blockchain and legal formats, which makes each transaction fixed and transparent and garners trust from all parties involved. It appeals to funders because it’s less risky than small business loans and they receive a coupon payment on each certificate issued.

SYME share price volatility

Since the beginning of August, the SYME share price has enjoyed a spectacular rise, up over 1,000% at one point. But since mid-August it has seen extreme volatility. At this stage it’s very much a speculative investment, but the European inventory financing market has a potential value of nearly €2 trillion, which is largely fuelling the positive sentiment. Harnessing even a tiny portion of this could mean massive upside for this share, propelling it to become a UK share to buy.

Covid-19 has boosted the likelihood of this business model becoming successful. The disruption to supply chains caused at the beginning of the pandemic showed weaknesses in the system. This option to monetise inventory could encourage companies to boost inventory levels, protecting against supply chain issues that may cause a future loss in sales.

So, the penny has finally dropped, and I now have a clearer understanding of what this strange sounding company does. Its business model looks credible, the market potential is astronomical, and its recent bull run proves there’s confidence in its ability to deliver. Would I invest? I don’t think I’m confident enough yet. I prefer to invest in companies with a sound track record, growth prospects, and a dividend yield. Although it has growth prospects, the other factors make me think it carries significant risk. For now, I’ll wait and see.