easyJet (LSE:EZJ) shares are trading lower today, just like the whole FTSE 100. Are the shares worth buying now? Or is it the beginning of a crash?

easyJet shares

This August was a beautiful time for stocks generally. And so was it for UK investors. It looks like last month was the beginning of a turnaround for easyJet shares too.

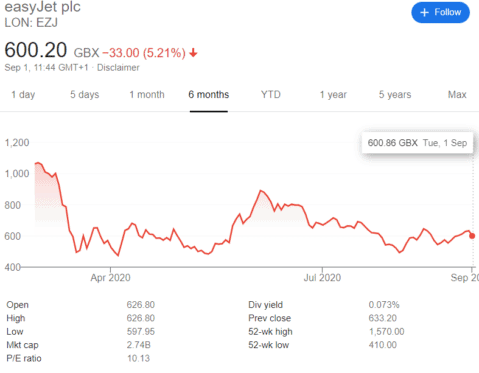

Source: Google Finance

As can be seen from the graph, the stock reached its bottom on 31 July. In August it rallied. But the question is whether that rally will last.

easyJet shares and air travel

Nothing important has recently been announced by the company itself. The state of air traffic in the UK isn’t particularly inspiring right now. Quite regularly new countries are added on the quarantine list. This means that passengers arriving from those countries must self-isolate for two weeks. But, unfortunately, the problems don’t end here. Passengers are required to wear masks while on flights. And, well, many of them are unwilling to do so. But it does not just raise the infection risk. It also means many people are discouraged from travelling. Some are simply afraid of catching the coronavirus. But others aren’t uncomfortable with face coverings and social distancing measures. All that means that the demand for air travel will stay under pressure for some time. And so will the air travel companies’ sales revenue.

I am writing on how it looks from a personal level for firms like easyJet. It seems to me that my colleague Edward is right in saying that easyJet shares are simply not worth buying. However, I do see two key questions here. The first one is how long the coronavirus crisis will last. The second is how long easyJet can afford to wait for the sector’s rebound.

Cornavirus crisis

Although it looks like the infection rate in the UK stabilised somewhat, there is a risk of another Covid-19 wave. The US, for example, is going through one. The key question here, I think, is when the world will get access to an effective vaccine. Only after a dramatic plunge in the number of new coronavirus patients will the existing travel restrictions be removed, I believe. I really hope it will happen soon. But it doesn’t look like it will happen tomorrow. So, how long can easyJet cancope with the air travel crisis?

easyJet fundamentals

As we all know, the company is currently loss-making. It still has to service its planes and pay wages to its remaining staff. At the same time, the revenue for the third quarter was just £7m. The loss, meanwhile, was (£324.5m). The good thing is that easyJet has a sound cash pile. In March the company announced it had liquidity to survive nine months of groundings. easyJet resumed a limited number of flights on 15 June. So, the company’s fleet isn’t completely grounded. What’s more, the company is a low-cost airline, which is one of the company’s competitive advantages. When people don’t have enough cash, they tend to look for cheaper alternatives. If the economic crisis continues even after the outbreak, easyJet will be here to gain.

Deciding whether it’s worth buying easyJet shares depends on your patience and willingness to take on risk. If you can wait, then buying the stock might be a smart move.