Novacyt (LSE:NCYT) shares have soared from around 15p since the start of the year to about 285p today. The rise is impressive but is the biotechnology company’s stock a good buy now?

Novacyt’s shares rise dramatically

To start with, Novacyt specialises in producing and selling medical equipment. Health professionals use it in detecting diseases. Before the coronavirus pandemic affected most countries around the globe, Novacyt traded for 15p per share at the end of January 2020. However, it is now trading for around 285p per share. What’s the reason for this surge?

Well, the reason is the soaring demand for coronavirus testing equipment that Novacyt specialises in. As my colleague Alan Oscroft points out, there has been an impressive sales boost because the company started selling the right equipment at the right time. Indeed, the estimated sales revenue of £120m for 2020 is much higher than 2019’s £11.5m.

But how sustainable is this extraordinary sales boost? And how about the surging Novacyt shares? In my view, all this isn’t sustainable at all. I have mentioned several times that the coronavirus pandemic is far from over. But at the same time it doesn’t mean that the current situation will last forever. As we have all heard, a coronavirus vaccine is expected to be ready by the end of 2021. If that happens, we will end up getting far fewer coronavirus cases. As a result, the demand for Covid-19 testing equipment will fall substantially.

There is also the classic threat of rising competition in this field. Indeed, a number of companies are, or have been, selling equipment and drugs useful in the treatment of Covid-19. Consider anti-malaria drugs. So, when more firms start producing coronavirus testing equipment and the pandemic is over, Novacyt shares will fall in value.

Novacyt’s fundamentals

But let us consider the company’s accounting fundamentals. I’d like to appeal to Benjamin Graham, the father of value investing. He introduced the concept of intrinsic value. This involves measuring the real value of a particular company’s stock by taking into account its earnings per share (EPS) and the EPS growth rate. If we apply this concept to 2018 and 2019 earnings, we will end up with a negative intrinsic value. That’s because those earnings were negative. The pretax loss totalled €2.1m in 2018 and widened to €3.9m in 2019. The 2020 earnings are not out yet. Graham also liked earnings to be stable, which doesn’t seem to be the case here, either.

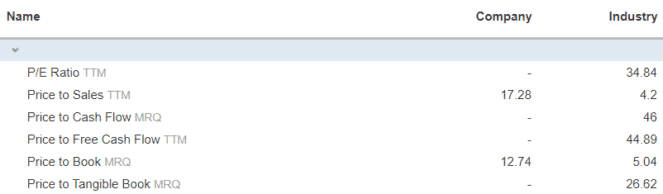

Some accounting multipliers allow us to understand that the company isn’t a bargain at all. Novacyt’s ratios are compared to the industry’s averages below. Remember that the industry also includes large and profitable companies. The price-to-book and the price-to-sales ratios are above the industry’s averages, which make the shares look overvalued to me.

Source: Investing.com

Finally, it’s more of a risk to invest in small companies. With sales figures of £11.5m for 2019, Novacyt is small.

Is Novacyt still a buy?

I don’t think so. Buying now at such a price seems speculative to me. There are plenty of other companies deserving your attention.