Shares of BP (LSE:BP) rallied yesterday, for a few reasons. OPEC+ decided to extend their oil production cuts for one more month. The future generally for oil companies is looking better as result of the gradual reopening of economies worldwide. And, the company decided to cut some jobs.

Will these positive influences continue, making the BP shares a buy right now?

BP’s shares

Yesterday there was a great rally for oil stocks generally as result of the OPEC+ announcement and better economic outlook. BP’s rally could also be attributed to news the company cut 10,000 jobs. This might seem like a worrying sign for many investors, but it should allow the company to conserve cash and become leaner and fitter.

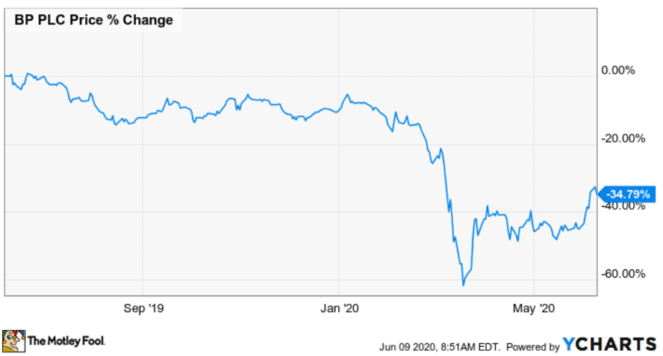

As you can see from the graph above, the BP shares have recovered somewhat, but they have not fully recovered from their March lows. Of course, the coronavirus pandemic and lockdowns kept many people at home and many businesses shut. So, demand for oil plunged to record low levels. Oil futures have not fully recovered either.

BP’s future

Even though I like being a contrarian investor, I am still quite sceptical about the industries hardest hit by the Covid-19 crisis. This is because the second wave of infections might be more dramatic than the first. I think the likelihood of a second Covid-19 wave is quite high. As a result of early reopenings, there is already a record number of hospitalisations in Texas. Unfortunately, this is probably just the beginning.

Eventually, the industries most hit by the Covid-19 will eventually recover, including the oil industry. However, I believe that only the fittest will survive. It seems to me that BP is an excellent example of a company that will survive and flourish due to its size and financials.

The oil company’s fundamentals

BP is one of the largest oil companies in the world with a long operating history. It enjoys a high investment-grade credit rating issued by Moody’s. The operating performance of the company has recently deteriorated due to low oil prices, but the company is planning to cut costs by $2.5bn by 2021.

At the same time, the company is trying to raise more cash. For example, it decided to sell its Alaska assets. The company’s 2020 investments will even decrease by 25% to save cash and lower operating costs.

The fact that BP did not cancel its dividend payments is also a comforting sign for shareholders.

This is what I’d now

In my view, healthy best-in-class companies should be bought at every possible correction. I would probably prefer BP’s shares to move lower for me to buy them. It is not usually a good idea to buy shares during a market rally. At the same time I’d recommend buying such companies for the long term. This is because the economic outlook is still uncertain and I think that investors might have to be patient. But I am sure brave long-term investors that are willing to buy and hold will eventually benefit.

But there are many other good FTSE 100 companies to be bought now for a diversified income portfolio.