US President Trump says that China could be held accountable for the coronavirus situation. If history is any guide, this raises the likelihood of a prolonged trade war. Even though it makes the overall outlook grim, some UK businesses would be hurt more than others. So, which FTSE 100 companies would suffer the most in 2020 if the trade war continues?

2020 outlook

The coronavirus pandemic is not just a medical challenge, it is also an economic disaster. However, most countries have started easing restrictions. So, there is some reason to be optimistic. Still, the economic impact from Covid-19 is not limited to the current lockdown.

On Thursday, Trump said that his phase one trade deal with China, signed in January, was of secondary importance. Indeed, his administration is thinking of retaliatory measures against China. In Trump’s view, it is necessary to investigate China’s role in the pandemic.

Remember that 2018 and 2019 were marked by significant stock market volatility as a result of the uncertain state of trade negotiations between the US and China. I think that a further battle between the two countries could have a prolonged negative impact on the FTSE 100.

FTSE 100 companies to suffer?

It is hard to predict how long these tensions will last and what measures Trump will take. However, some top UK firms have solid balance sheets, good earnings track records, and a lot of cash. At the same time, large FTSE 100 companies are international and rely heavily on global markets. So, there is a big risk for investors. Here I’ll talk about some of the most exposed companies.

HSBC

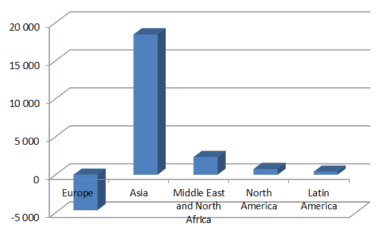

HSBC (LSE:HSBA) was established in 1865 in Hong Kong. An enormous part of its revenue and profits comes from Asia. Here’s the breakdown of the 2019 profit figures and the regions where these profits come from.

Distribution of profits/(loss) before tax by geographical region in 2019 in $ millions

Source: HSBC

As you can see, this giant relies heavily on Asia, where China is a dominant power. Trade tensions between the US and China have impacted the bank in the past. There is no reason to expect this change.

Although HSBC is Hong Kong’s dominant bank, the financial giant has always targeted expansion in Mainland China. The US-China trade war might be a big hurdle in this situation.

Burberry

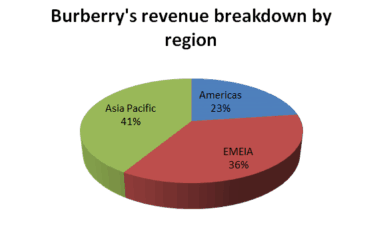

A very well-established fashion company is likely to struggle as a recession is around the corner. This is because consumers in the UK are less likely to purchase non-essentials as their incomes fall. However, UK and European markets are less of a concern for Burberry (LSE:BRBY).

There is high demand for luxurious goods from Western countries in China. This demand is due to the rising middle class. So, a lot of high fashion firms rely on China as a major market. Asia Pacific accounts for 41% of Burberry’s revenue. Most of these sales are in China. Yet, as the trade war seems to intensify, it is logical to predict that consumer incomes in China will fall. I think that this will lead to falling sales for Burberry in this country.

Source: Burberry

Conclusion

In no way do I consider these companies to be weak, but now might not be the right time to buy their shares.