If you’re looking for FTSE 100 dividend stocks to buy and hold for the next decade, it’s worth thinking about long-term revenue drivers. Ideally, you want to invest in companies that are set to benefit from powerful long-term trends.

With that in mind, here’s a look at three FTSE 100 dividend-paying companies that I believe are well positioned to profit from dominant structural trends over the next 10 years.

Diageo

The first dividend stock I’d like to highlight is alcoholic beverage champion Diageo (LSE: DGE), which owns an outstanding portfolio of brands including Johnnie Walker, Tanqueray, and Smirnoff.

The reason I like Diageo as a long-term buy-and-hold is that the company has significant exposure to the world’s emerging markets. What this means is that the firm is likely to benefit from both rising populations and rising incomes in the years ahead. Indeed, Diageo says that it expects another 550m new legal drinking age consumers across the emerging markets to enter the market by 2030 while it expects an additional 750m consumers to be able to afford international-style spirits by 2030. That’s a considerable number of extra consumers!

Diageo isn’t the cheapest stock in the FTSE 100 (forward-looking P/E ratio of around 23) and its yield isn’t that eye-catching either (2.3%). I wouldn’t let these metrics put you off though – this is a high-quality company with a fantastic dividend growth track record.

Prudential

Next up, financial services group Prudential (LSE: PRU). What appeals to me about PRU is that, after its recent demerger with M&G, the company is largely focused on the savings and insurance needs of those in Asia.

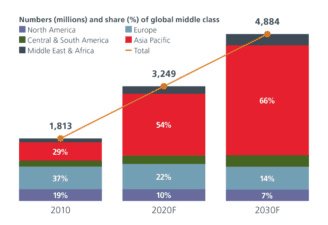

Why is this such a big deal? Simply because incomes across Asia are growing at a rapid rate. Indeed, by 2030, Asia will represent 66% of the global middle-class population, according to projections from the Organisation for Economic Co-operation and Development (OECD), up from around 54% today. This rise in wealth across Asia is likely to create a strong demand for financial services products such as savings accounts and life insurance.

Source: Prudential

Prudential shares have been a little out of favour recently due to the trade war situation and the protests in Hong Kong. I think this has created an attractive buying opportunity for long-term investors. Currently, the stock’s forward-looking P/E ratio is just 10, and the prospective yield is about 2.8%.

DS Smith

Finally, check out sustainable packaging specialist DS Smith (LSE: SMDS). It specialises in manufacturing cardboard boxes (the type Amazon deliveries come in).

To my mind, DS Smith looks set to benefit from two powerful trends in the years ahead. Firstly, there’s the growth of e-commerce. These days, more and more consumers are shopping online and this is a trend that looks set to continue. According to Statista, global retail e-commerce sales could climb to $6.5trn by 2023, up from around $3.5trn today. This means that demand for packaging is only likely to increase over time.

Secondly, there’s the focus on sustainability. Increasingly, consumers are ditching plastics and looking for sustainable packaging solutions. Given that sustainability is at the heart of DS Smith’s philosophy, I see an attractive long-term growth story here.

DS Smith shares currently trade on a forward-looking P/E ratio of 11.2 and offer a prospective yield of a healthy 4.3%. Looking at those metrics, I think the stock offers a lot of value right now.