Shares of used car supermarket Motorpoint Group (LSE: MOTR) rose by 10% when markets opened this morning after the company said that its full-year profits should be “at the upper end of market expectations”.

Motorpoint only sells cars that are under three years old and have less than 25,000 miles on the clock. So these cars are a good alternative to buying new, with many still having manufacturer warranties.

This could be an opportunity

Listed new car dealership groups have generally performed poorly over the last year, as new car sales have slowed.

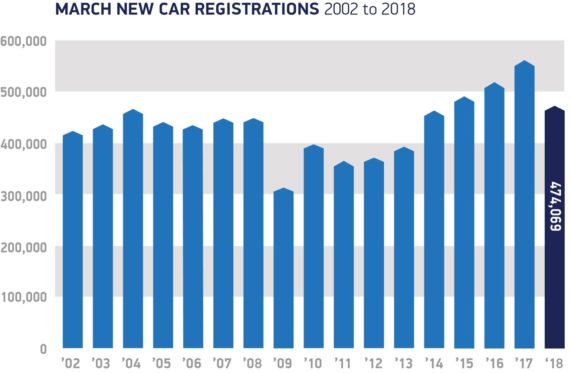

Figures released this week by the Society of Motor Manufacturers and Traders (SMMT) show that this decline continued last month. New car sales fell by 15.7% to 474,069 in March, compared to the same month last year. March 2018 sales were also lower than in 2015 and 2016.

For franchised dealers these figures are a concern. But they may represent an opportunity for Motorpoint. The company said today that it expects to report full-year revenue growth of more than 18%, helped by the opening of a 12th site at Sheffield.

The biggest risk for investors is probably that used car prices could fall, decimating profits. So far this doesn’t seem to have happened. Motorpoint said today that gross profit margins per car sold “remained stable throughout the year”.

As a shareholder, I’ll be taking a closer look at Motorpoint’s financial performance when its full-year results are released in June. But based on the information provided today I’m happy to continue holding the stock.

I estimate that after today’s gains, the shares trade on a forecast P/E of 13.5 with a prospective yield of 2.4%. I believe this stock may still rate as a growth buy.

I might look overseas

The problem with Motorpoint and most other listed car dealers is that they’re dependent on UK car sales. So if the UK economy slumps after Brexit, business could be tough for a while.

One way to play this risk is to invest in a company that sells cars overseas, such as Inchcape (LSE: INCH).

This group does sell cars in the UK, but its main focus is overseas distribution. This means it partners with car manufacturers to take complete responsibility for logistics, marketing and retail operations in the territories where it operates. Doing this means that car manufacturers don’t have to set up their own independent operations in each country.

Distribution appears to be a more profitable business than operating franchised dealerships. I believe it also has greater growth potential. Inchcape operates in some of the world’s fastest-growing car markets, such as Asia and South America, where car ownership levels are still much lower than in the UK.

Stunning financials

Last year saw revenue climbing 14% to £8.9bn and adjusted pre-tax profit rose 9.5% to £382.5m. Operating margin was stable at 4.6% and free cash flow rose by 64.8% to £313.9m. Return on capital employed rose from 15.2% to 19.9% — a very creditable result.

I believe the geographic diversity of Inchcape’s business means that it’s likely to deliver a very stable performance over the next few years. The stock currently trades on a forecast P/E of 11 with a prospective yield of 3.7%. In my view, this looks like a low-risk buy for dividend growth investors.