Neil Woodford and Nick Train are two of the UK’s most celebrated fund managers. A glance at Hargreaves Lansdown’s funds page will tell you that Woodford’s Equity Income fund and Train’s UK Equity fund are the two most popular funds in the country right now.

However, it’s fair to say that they have had very different years. While Train has returned around 23% over the last 12 months, Woodford’s flagship fund has returned just 2%. That’s quite some difference. So what’s going on?

Different investment styles

Much of the performance differential over the last year can be attributed to the different investment styles of the two.

Woodford is more of a value investor. He picks out companies that look attractively valued and only invests where he sees a compelling long-term opportunity. In the last year, he has increased his exposure to domestically-focused businesses such as Lloyds Banking Group and the UK housebuilders as he believes these companies offer long-term value.

A snapshot of his top 10 holdings is below:

|

Source: Hargreaves Lansdown. Data as of 31/10.

While his strategy sounds good in theory, it has no doubt delivered an underwhelming result this year. Growth stocks have been in vogue, while many value stocks have been left for dead. Adding to Woodford’s woes has been the abysmal performance of key holdings such as Provident Financial, which has lost 70% of its value.

In contrast, Nick Train invests with a Warren Buffett-esque approach to the stock market. Less concerned with finding bargain companies, Train seeks out fantastic companies that have strong competitive advantages. His portfolio contains popular names such as Unilever and Diageo – stocks that have excellent track records but also trade at lofty valuations. His top 10 holdings are below:

|

Source: Hargreaves Lansdown. Data as of 31/10.

Looking at those companies, it’s not hard to see why Train’s portfolio has performed well in 2017. RELX is up almost 20% for the year, while Diageo and Unilever are up 25% and 26% respectively.

Who will outperform in 2018?

So which fund manager is best positioned for 2018? Will Woodford’s value approach prevail or will Train’s growth approach continue to generate strong returns? That’s hard to call. To my mind, it depends on whether growth investing remains on trend, or investors turn back to value stocks.

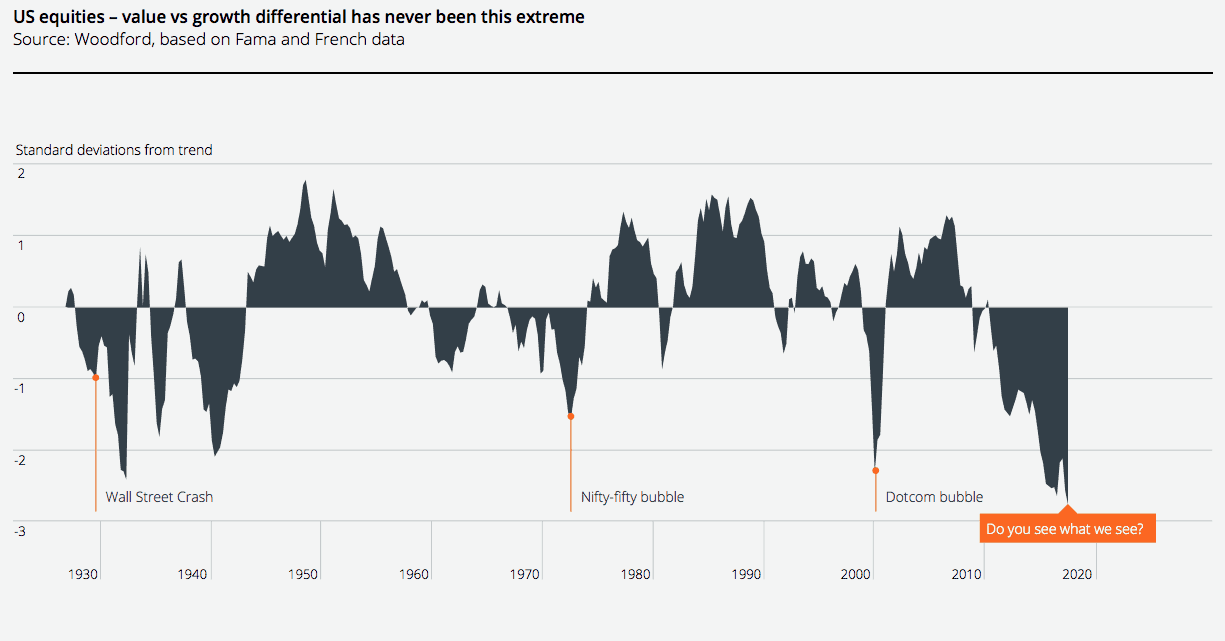

Woodford recently stated that he believes the difference between the performance of US value stocks and growth stocks today is “greater than at any stage in stock market history.” The chart below is definitely concerning.

Source: Woodford Investment Management

At some stage in the future there is likely to be a reversion. Growth stocks will lose their shine and investors will focus on areas of the market that offer value. That may happen in 2018 or it may not.

Overall, if I had to pick one investment style heading into 2018, I’d probably lean towards Woodford’s. Stocks such as Imperial Brands, Lloyds and Legal & General all offer excellent value right now, in my view. In contrast, Train holdings Diageo and Unilever look ripe for a pullback.

Having said that, given that both fund managers have outstanding long-term track records, the best idea might be to diversify and invest with both.