Considering getting a rewards or cashback credit card? Here’s everything you need to know before applying.

What to consider when comparing rewards credit cards:

- Type of rewards: The main types of rewards are flexible points, cash back, travel points, and brand-specific points. Each has pros and cons you’ll want to review.

- Fees: Aim to keep fees as low as possible, but be sure to read the fine print. One card may have no annual fee but have a high foreign transaction fee. Be sure to evaluate the total cost you’ll face from a card.

- Rewards yield: Look for cards that have higher earn rates so you get more value for each £1 you spend. When there’s a tiered system with bonus points for certain categories, make sure those bonus tiers align to your typical spending.

- Welcome bonus: Wouldn’t it be nice to get rewards just for signing up? If you can’t make your decision based on the factors we’ve already listed, the sign-up bonus can be a good tie-breaker.

With these factors in mind, you’re ready to start looking for the best rewards credit card for you.

What is a rewards credit card?

A rewards credit card is a credit card that offers rewards for spending. Rewards can vary, but typically come in the form of reward points, cashback or Avios.

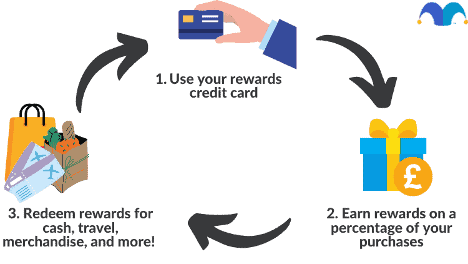

How do rewards cards work?

With rewards credit cards, you don’t have to do anything special – aside from using the card – when you spend. You just swipe your card and earn rewards.

Of course, this is how to earn rewards with a rewards card. To make the most of your card, you’ll need to pay off your card’s balance every month to avoid racking up interest charges.

It’s worth noting that while earning rewards is nice, this isn’t a good reason to overspend or buy things you can’t afford. Getting rewarded for spending you would have done anyway is great. But spending beyond your means can cause problems that even the best rewards programmes can’t mend!

Types of rewards cards

Credit card rewards come in three main forms:

1. Reward points

Points cards give borrowers a fixed number of points per £1 you spend. The reward rate will depend on which card you choose. Cards that offer reward points are often affiliated with a retailer or supermarket and offer higher reward points on money spent in store compared with that spent elsewhere.

For example, you could earn one point for every £1 you spend in store, but only one point for every £2 spent at another retailer. Typically, reward points accrue over 1-3 months and are then given to the cardholder in the form of a voucher.

2. Cash back rewards

Some cards offer rewards in the form of cash back. The level of cash back you can earn depends on the individual card.

For example, you could receive a cashback yield of 0.5% for every £1 spent, meaning if you spent £100 on your credit card you would earn 50p of cashback. It is best to check whether a particular cashback card has any limit on how much cashback you can earn over a certain period.

3. Avios rewards

Previously known as Airmiles, Avios rewards cards are travel rewards and work generally the same way as the other types of rewards cards, but are targeted towards frequent travelers. They allow you to put your points towards paying for air fares, hotels, and other travel perks.

Rewards cards vs. cashback cards

A cashback credit card is simply a type of rewards credit card. But there are still quite a few nuances between the two types of cards. Below we break down a list of important differences between a cashback credit card and a reward credit card:

Earning Rewards

Cashback: While not true for all cashback cards, most are meant for everyday spending and allow you to earn rewards on everyday purchases.

Rewards: While there are more flexible options, it’s more common for a rewards card to be restricted to earning rewards at certain retailers or on certain types of purchases.

Validity Period

Cashback: Typically, once cashback has been applied to your account, you can use it whenever you like. There is not usually a validity period.

Rewards: Depending on your lender, reward points tend to remain valid for two or three years before expiration.

Rewards Redemption Options

Cashback: Once your cashback has been applied to your account, you can use it however you wish.

Rewards: Reward points can often only be spent on websites linked to your lender.

Minimum Transactions

Cashback: Many cashback credit cards don’t require a minimum transaction – you can earn cashback even on small spends.

Rewards: Depending on your lender’s specific terms and conditions, you will sometimes need to make a minimum spend per transaction to earn reward points.

Calculation of rewards

Cashback: Percentage cashback should be visible on your credit card offer, so it is usually quite simple to calculate the cashback for any particular transaction.

Rewards: Reward points can vary between transactions, sometimes making it difficult to calculate how many reward points you will earn.

Extra Bonuses

Cashback: It is not common to see additional bonuses with cashback credit cards – you typically earn cashback only on what you spend.

Rewards: Some reward credit cards will give you extra reward points when you achieve a milestone or a reach a transaction limit.

Earning Timeline

Cashback: When you receive your cash back varies between credit cards. Some apply the cashback immediately after a transaction whereas others you have to wait for 90 days.

Rewards: Reward points tend to show up on your account straight away after you’ve made a transaction.

Welcome Offers

Cashback: Cashback credit cards don’t tend to give welcome offers – cashback will not automatically appear when you activate your card.

Rewards: Some reward credit cards offer bonus points when you activate your card that you are free to spend when shopping.

Rewards Limits

Cashback: There is usually an upper limit for earning cashback with specific brands and offers.

Rewards: Generally, the more transactions you make, the more reward points you’ll earn. There isn’t usually an upper limit.

What is the best credit card for rewards in the UK?

The answer may be disappointing, but we can’t really say that any one credit card is the best rewards credit card in the UK.

Why’s that? Because many programmes are aimed at specific types of redemptions or specific places to shop. A card with great Avios rewards may be considered a superb programme for a frequent traveller. But for someone that rarely travels, it’d be a fairly miserable reward system. Likewise, a regular Tesco shopper may get a lot out of the programme on the Tesco credit cards. But if you don’t shop at Tesco, it won’t have the same value to you.

For that reason, it’s important to match the card‘s reward programme to your life and lifestyle. Just because you could theoretically get a high return from one card‘s programme doesn’t mean much if you’d have to change your life to actually see that high return.

Can you get a rewards credit card with bad credit?

A low credit score could make it difficult to be accepted for some rewards credit cards. It might still be possible to get a rewards credit card with bad credit, but your rewards card options and your access to the best reward card deals are likely to be more limited.

Can rewards credit cards improve your credit score?

Yes, making the minimum payment on your card each month shows lenders that you’re responsible with money, which can help your score over time.

That said, as with any credit card, if you max out your credit limit each month, you could end up lowering your credit score. Why? Using up all your available credit makes it look like you don’t have much control over your finances, which makes you appear riskier to lenders. It’s recommended that you don’t use more than 30% of your available credit. So if your card has a £1,000 limit, try to avoid using more than £300.

Here’s something else to bear in mind: the more you spend on your card, the higher your minimum payments, even with cash back or other rewards. If the payments go too high, you could struggle to keep up. Missed credit card payments will damage your score.

Should you have more than one credit card with rewards?

Having more than one reward credit card may allow you to capitalise on various rewards and deals.

However, having multiple credit cards can make it more difficult to keep track of spending and manage your budget. This can naturally lead to overspending for some consumers.

Although there is no fixed number as to how many cards you should have, it’s wise to consider the impact on your credit score and overall financial situation before getting more than one rewards card.

More on comparing rewards cards in the UK

Everyone’s financial situation is slightly different, so it’s important to know a bit about how to compare these cards on your own, so you can confirm that a particular card really does fit your personal circumstances.

Here are more details on the key features to compare when lining up rewards cards:

Rewards type

Unlike cashback cards, the earnings on rewards cards can be a bit more complicated. In some cases, these rewards can be restrictive. The John Lewis scheme, for instance, mails cardholders vouchers that can be used solely at John Lewis & Partners or Waitrose & Partners. Other programmes are more flexible.

For example, rewards earned with the American Express Membership Rewards programme can be redeemed on everything from car hire with Sixt and flights on British Airways to Amazon.co.uk gift cards or even paying part of your card balance with points. The bottom line is to choose a programme that fits you and your needs.

Rewards yield

This refers to how much rewards value you get for each £1 of spend. There are two parts to figure here.

First, you need to determine the rewards earning rate. That is, how many rewards points you get per £1 spent. With some schemes this is very easy, as you’ll simply get one point per £1 in spend. Other schemes have different levels of points depending on where you’re swiping your card. The latter is typical of store brand cards.

Next is the rewards value, or how much value you get per rewards point. Again, sometimes this can be easy to figure. The John Lewis card we mentioned mails £5 in voucher credit per 500 points. More flexible programmes – like Amex’s Membership Rewards – can be more complicated, as redeeming points for gift cards can, for example, have a much lower value per point than redeeming for airline tickets.

You don’t need to perform advanced mathematics here, but it’s a good idea to look at the rewards earning rates and rewards value in light of your own spending habits to help you compare the rewards value to you from various schemes.

Annual fee

Many rewards cards do not have an annual fee. That’s a great thing, since it means you get rewards without having to pay anything extra out of pocket. All else equal, we prefer rewards cards that don’t have a fee attached. But all else is not always equal.

Rewards cards with annual fees often allow you to accrue rewards at a faster pace or they may come with better perks, like access to airport lounges. The trick here is to compare the cost of the fee with the value that you’ll get out of the additional rewards or perks. At that point it’s simple: if you think you’ll get more value, then the fee is worth it. If not, skip the fee-carrying card and get one of the many cards with no fee.

Additional perks

Add-on perks come in many flavours. Some examples include:

- Accelerated rewards for spending with partners

- Exclusive access to airport lounges

- Early access to events tickets

- The value in these rewards is highly dependent on what’s important to you. But keep an eye out for them, because they can be valuable.

Foreign transaction fees

Most credit cards charge a fee of up to 3% when you transact in a currency other than sterling. This can be a real pain when travelling abroad. Travel credit cards waive this non-sterling transaction fee, so that you can spend abroad without stress.

Unfortunately, though many rewards cards offer travel-related rewards, few waive non-sterling transaction fees. So you may be best served earning rewards for your holidays with a rewards card, but then spending on your holidays with a fee-free travel card.

Welcome bonus

The idea of a sign-up bonus sounds great. Wouldn’t it be nice to get a big pile of rewards just for signing up? Don’t get us wrong, sign-up bonuses are great, but except for cards that carry annual fees, sign-up bonuses tend to be modest.

If you can’t make your decision based on the factors we’ve already listed, the sign-up bonus can be a good tiebreaker. But it likely shouldn’t be the primary factor you focus on when choosing a rewards card. And when it comes to cards with annual fees, the sign-up bonuses can be impressive, but the same rule holds as we discussed above: consider the value you get versus the annual fee you pay and only choose a card with an annual fee when you believe you’re getting more value than when you’re paying.

How to get the most out of credit card rewards

There are plenty of ways to accumulate extra points without spending extra money. Here are some top tips for helping you make the most of your reward card.

Use your card like a debit card

If you are looking to earn lots of rewards, then the best way to go about it is to spend lots of money – but rather than rack up lots of debt you can’t afford to repay, use your credit card like your debit card. If you make your credit card your main means of payment for everyday purchases but make sure you pay off the amount immediately or budget to pay off the full balance monthly, then you can maximise the amount of rewards you can earn. If you do all your spending in one place, then everything you spend is earning you a reward. Just make sure you keep on top of your balance, and don’t fall in the trap of spending above your means.

Add an additional user

Some reward cards let you add an additional user at no extra cost. This could be a partner or a close family member, who could then start accruing points with their own credit card linked to your account. Something to note though, is that adding an additional user makes you responsible for their debt. Additionally, any mistakes you make, like a late payment, will show up on their credit report and vice versa.

Put large expenses on the card

If you have some home improvements coming up or are looking to book a holiday, you could put the cost on your credit card and earn reward points as a result. This is best only done if the card also offers an introductory 0% interest period on purchases, or you plan to pay off the balance in full at the end of the billing period. Otherwise, you could run the risk of incurring interest charges on your balance and wiping out any reward benefits you have earned.

Card referrals

Look to see whether your credit card offers bonus reward points for referring someone else for the card. This is often a way of injecting bonus points into your account.

Select a reward card to suit you

Make sure the card reflects your shopping habits. You won’t really benefit from a Sainsbury’s reward scheme if you do all your weekly food shopping at Asda. If you are not a consistent shopper anywhere that offers a rewards card, you can consider cards like those from American Express, which have rewards points that are more flexible.

Consider switching credit cards or getting an additional rewards card

Credit card providers often provide nice benefits for new cardholders. This can include a welcome bonus or sign-up bonus, limited-time perks, vouchers, or a higher rewards rate. In some cases, a new cardholder can get a gold card or platinum card for a year without the usual annual fee. This may cause some extra administrative work on your end to track your cards and balances, so do make sure that the value of the extra rewards is worth it.

How to redeem credit card rewards

How you redeem your credit card rewards will depend on the type of rewards programme you choose.

Redeeming credit card reward points

You can typically redeem points through your card issuer’s redemption portal. Your options could include anything from gift cards, travel discounts, shopping redemptions, and more. Be sure to find out what redemption options a provider offers ahead of time, so you choose one that fits your preferences.

Redeeming credit card cash back rewards

It’s easy to redeem your cash back rewards. Like rewards points, you should find your cash back redemption options within your card issuer’s redemption portal. Most issuers allow you to redeem your cash back with direct deposit, statement credit, or a check payable to you.

Redeeming credit card miles rewards

You typically redeem Avios or air miles rewards for airline tickets, which can be done through your provider’s portal as well.

Things to look out for with rewards credit cards

As with anything, there is always a possible downside. A reward card may be the best option for you, but there are some things to be aware of before you get spending.

High representative APRs – Reward cards often have high interest charges. At the very least, you’re less likely to find high rewards rates paired with a particularly low representative APR. Therefore, reward cards are best suited to borrowers who can repay their balance in full each month. Any remaining balance, unless you have a card that offers an introductory 0% interest period on purchases, could incur interest charges that outstrip any reward benefits you might have accrued.

Be aware of annual fees – As mentioned before, some reward cards carry an annual fee. Cards with annual fees often have higher rewards rates and better perks, which can make the fee well worth it. But, you need to make sure that’s the case, or you could end up paying an annual fee and only cashing in rewards worth half that!

Know the terms – It is also best to look at what you can earn reward points on. Typically, reward points can only be accrued on purchases, so balance transfers would not qualify. Also, some cards specify which purchases qualify for reward points; for example, travel money purchases would be unlikely to earn you any reward points.

Don’t overspend! – You may get sick of hearing us say it, but it really can’t be said enough. Don’t take out a rewards credit card and use it as an excuse to spend more than you otherwise would. Briefly imagine two people. One person, we’ll call her Sophia Spendsright, has a bog-standard credit card with no rewards and spends £5,000 on that card during the year, paying off their balance every month. The second person, we’ll call him Jack Justonemorething, has a rewards card with a rewards rate of 1% on all purchases (pretty good!). Jack would have spent the same £5,000 as Sophia, but sees a football jersey for £75 (that he doesn’t need) and tells himself ‘it’s no problem to buy that, because I’m earning rewards!’ That’s true, but the rewards on the £5,075 that Jack spent through the year only amount to £50.75, meaning he spent £5,024.25 out of pocket – more than Sophia, even though she earned no rewards at all.

Is a reward credit card right for you?

As with any credit card, you must look at your individual circumstances. If you think you can pay off your balance in full every month and would spend enough on a credit card to accrue points, then a reward card could be a good fit for you.

As to which reward card you select, the best choice depends on where you tend to shop, and which vouchers you would get the most value from. When choosing which card to apply for, decide on the type of rewards you want to receive, calculate how much you are likely to spend on that card each year, and then compare the rewards you would earn on that amount from a range of different cards.

It is also best to check the application criteria for the card, to assess whether you would be likely to be accepted.

Learn more

Frequently Asked Questions

-

The answer may be disappointing, but we can't really say that any one credit card in the UK is the best credit card for rewards.

Many programmes are aimed at specific types of redemptions or specific places to shop. A card with great Avios rewards may be considered a superb programme for a frequent traveller. But for someone that rarely travels, it'd be a fairly miserable reward system. Likewise, a regular Tesco shopper may get a lot out of the programme on the Tesco credit cards. But if you don't shop at Tesco, it won't have the same value to you.

For that reason, it's important to match the card's reward programme to your life and lifestyle. Just because you could theoretically get a high return from one card's programme doesn't mean much if you'd have to change your life to actually see that high return.

-

With rewards credit cards, you don't have to do anything special -- aside from using the card -- when you spend. You just swipe your card and earn rewards.

It's well worth noting that while earning rewards is nice, this isn't a good reason to overspend or buy things you can't afford. Getting rewarded for spending you would have done anyway is great. But spending beyond your means can cause problems that even the best rewards programmes can't mend!

-

As with any credit card, you have to look at your individual circumstances. If you think you can pay off your balance in full every month and would spend enough on a credit card to accrue points, then a reward card could definitely be worth it for you.

Just be cautious not to take out a rewards credit card and use it as an excuse to spend more than you otherwise would. In that case, it's not a good idea.

-

Having more than one credit card may allow you to capitalise on various rewards and deals.

However, having multiple credit cards can make it more difficult to keep track of spending and manage your budget. This can naturally lead to overspending for some consumers.

Although there is no fixed number as to how many cards you should have, it is logical to consider the impact on your credit score and overall financial situation before getting more than one rewards card.

-

Generally, rewards are not taxable. The rewards points, back, or miles you earn through everyday are considered rebates or discounts and are therefore not taxed as income.

However, rewards that are awarded as an incentive, such as a bonus for opening an account without you any of your own money could be considered taxable income. It's best to read your 's fine print and seek professional advice if you're unsure.