Stock markets are becoming more volatile. The second wave of the coronavirus has the potential to cause another full-blown stock market crash. The trouble is no one can say for sure that it will, or when it will be, how deep it will go, or how long it will last. Given there is a lot of uncertainty in the markets, it’s hard not to wonder if now is a good time to buy stocks or not. I believe it is, but I then again, I always do.

If I cannot get reliably time the market, then there is no point trying. So, I regularly invest no matter if the markets are up or down. It is challenging to buy when prices are falling. However, I know that if I am regularly investing for the long term, in a basket of stocks that I believe will be worth more in 10 years than they are now, I should be okay. In fact, market crashes can increase my wealth so long as I have the time to ride them out.

Stock market crashes

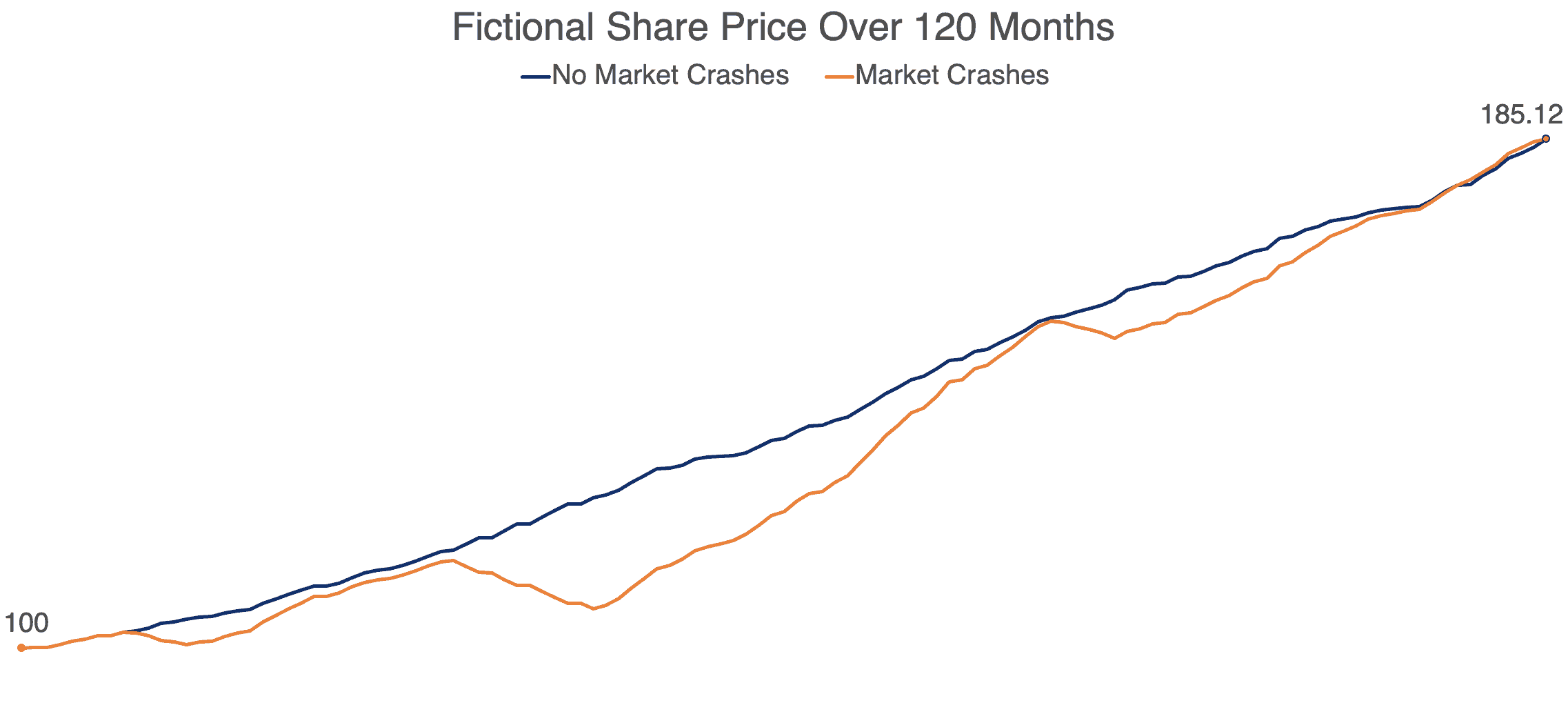

Let’s consider two scenarios for a fictional share. In both cases, the share price starts at 100p and ends at 185.12p But in one scenario the share price moves up a little each month, while in the other, the share price is a lot more volatile. The chart below shows how the price of this fictional share will behave over 120 months under both scenarios. I am going to invest £1,000 in this stock initially (which buys 1,000 shares) and then £100 each month for 119 months. In the first scenario:

With no market crashes, as the price rises ever higher, my £100 investments buy fewer and fewer shares as time goes by. Nevertheless, after 10 years I end up with 9,929 shares, which at a price of 185.15p each are worth £18,381.01. However, with market crashes, there are periods where a £100 investment buys more shares than it previously did. And so, in the market crash scenario, I end up with 10,337 shares, which at a final price of 185.12p are worth £19,135.42.

With no market crashes, as the price rises ever higher, my £100 investments buy fewer and fewer shares as time goes by. Nevertheless, after 10 years I end up with 9,929 shares, which at a price of 185.15p each are worth £18,381.01. However, with market crashes, there are periods where a £100 investment buys more shares than it previously did. And so, in the market crash scenario, I end up with 10,337 shares, which at a final price of 185.12p are worth £19,135.42.

| Market Crashes | No Market Crashes | |

| Total Invested | £12,900 | £12,900 |

| Final Share Price | 185.12p | 185.12p |

| Number of Shares | 9,929 | 10,337 |

| Market Value | £18,381.01 | £19,135.42 |

| Average Share Price | 129.92p | 124.79p |

Under the market crash scenario, the same investment was worth 4.10% more at the end than under the no market crash scenario. If the stock paid a dividend, then the difference would be greater. If I knew that the starting and ending share prices would be the same, I should prefer market crashes along the way. Of course, I would never invest in a single share, but rather a basket of them to diversify company-specific risk. This example used a single share only for simplicity.

Always a good time to buy stocks

Stock markets crash, that’s just something investors will have to get used to. But, since I am investing regularly in a basket of what I believe are quality stocks, I do not despair when prices start to tank. In fact, so long as I have confidence that the companies I invest in will grow larger over 10 years or so, I should prefer the stock prices to dip along the way. So, I always think now is the right time to buy into a basket of quality stocks.