Money printing. The Germans did it in the 20th Century and the French in the 18th. The Romans did it 2000 years ago. Henry VIII did it, too. In every case in history, money printing and currency debasement (lowering the value of currency) has inevitably led to inflation.

Yet have we learnt from our mistakes? Central banks have been pursuing policies of mass money printing under the guise of ‘quantitative easing’ (QE). This involves the creation of new money to buy bonds and other assets in order to inject new money into the economy. Sounds great, right?

The idea was that central banks like the Federal Reserve could kickstart their economy on a bad day and balance the books later on when everything was going well. Only that never happened. QE started in 2008, with another round in 2010 and yet another round in 2012. But the balancing of the books never came. Now with coronavirus, the Fed has pledged to do “whatever it takes” — aka QE infinity.

We’ve all been told that this won’t cause inflation. “Just look at the Consumer Price Index” (CPI), they say. Yet the CPI doesn’t include assets like house prices. Aren’t house prices something a consumer is interested in?

Inflation is rising fast, we just haven’t seen it in our day-to-day lives – but soon enough, it will creep its way into the CPI.

How is this related to gold?

Well, all this money printing means more cash is chasing the same amount of stuff. No matter how much money you print, there is the same amount of gold as there was before, but more money to buy it with. It’s not a coincidence that the gold price has been soaring since 2008, when QE1 began.

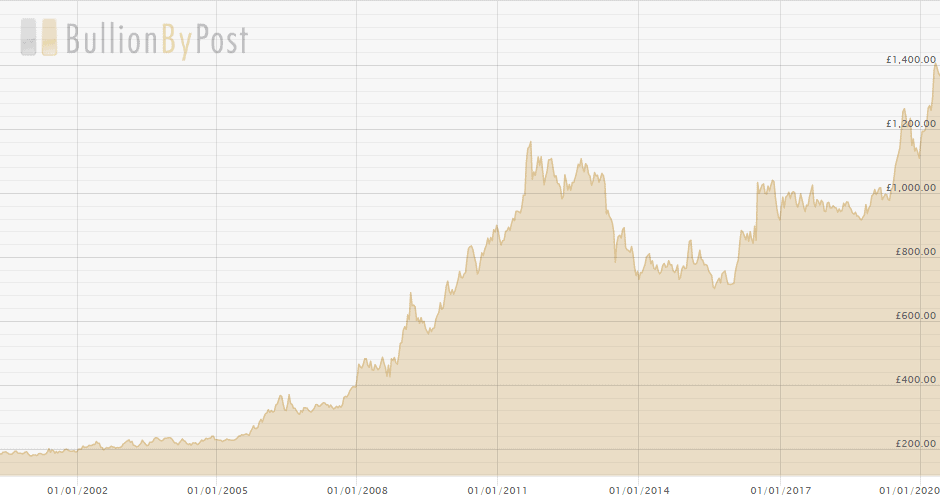

Image source: BullionByPost.co.uk. Gold price (£ per ounce) 2000-2020

You can see how quickly gold prices shot up from 2008 until 2012 (when the Fed announced relaxation of QE) — and you can see it ramping up again.

Gold-mining stocks in demand

The savvy investor will want to profit from this, and here’s how:

- You can buy gold itself. The Royal Mint Bullion offers the opportunity to buy and sell physical gold. Alternatively, investors can consider physical gold exchange-traded funds (ETFs), such as the WisdomTree Physical Gold ETF or the Invesco Physical Gold ETC. The only concern is gold’s volatile price. You shouldn’t put a big chunk of your portfolio in any commodity.

- You can buy gold-mining companies’ stocks. Within the FTSE 100 and FTSE 250, companies that mine gold include Chile’s Antofagasta, Mexico-based Fresnillo, Russian mining operation Polymetal International, and Centamin (LSE: CEY), which focuses on the Arabian-Nubian Shield. Gold-mining stocks tend to be more stable than the underlying commodity and they pay dividends!

If you have some money set aside for investing — say, you’ve saved £1k from recent pay cheques — my top pick in the gold sector is FTSE 250 firm Centamin, which produces gold from its Sukari mine in Egypt. Like most gold miners, Centamin has benefited from the run-up in the price of gold over the last five years. But cuts to production guidance have seen the shares drift lower since 2017. However, with prices rising and potentially rising even faster soon, profits could be set to shoot up. And with a dividend yield of 5.2%, a share price of 162.4p doesn’t look too pricey to me.