5G is Here — And Shares of This ‘Sleeping Giant’ Could Be a Great Way for You to Potentially Profit!

According to one leading industry firm, the 5G boom is expected to create a global industry worth US$12.3 TRILLION out of thin air…

And I’m about to show you something that could be key to unlocking 5G’s full potential.

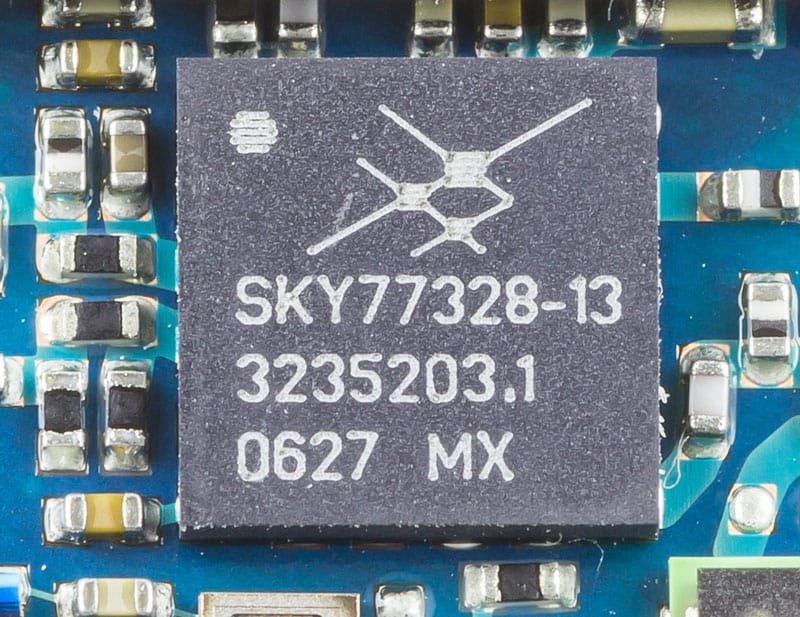

Just take a look at this photo…

Image credit: © Raimond Spekking / CC BY-SA 4.0 (via Wikimedia Commons).

Now, at first glance, you might think this is just some fancy computer chip…

But it’s actually a very big deal.

As you may know, 5G — the blazing-fast next generation wireless network — is already starting to spread rapidly across the USA.

And although you might not realise it — given how China’s Huawei has dominated 5G news stories over the past few months – the UK isn’t hanging about either…

BT (LSE: BT.A ) through its EE network and Vodafone (LSE: VOD) have been leading the charge, quietly rolling out their new high-speed services in earnest — bringing 5G network coverage to roughly 50 large UK towns and cities so far.

And with a report last year from Barclays (LSE: BARC) indicating that 5G technology could boost the UK economy by as much as £15.7bn by 2025 (assuming a rapid rollout) you can see why the government has been eager to draw a line under the Huawei controversy — by limiting its involvement in the UK’s 5G network — and to crack on.

But there’s a catch here…

You see, devices like your phone and tablet all require special hardware to make use of 5G networks.

Which means that tiny part I showed you is absolutely critical to make 5G work.

And it’s just ONE innovation from a little-known company that has quietly spent years preparing for this exact moment…

Listen — I’m no tech genius, but I reckon I know a big investment opportunity when I see one.

You see, that forward-thinking tech company has already built this crucial component that every smart device will require to take advantage of 5G.

And that’s where this gets especially exciting for everyday investors like yourself…

Because management has revealed that this 5G hardware could usher in a 39% increase in revenue generated per phone.

And with 2 of the world’s top 5 mobile phone manufacturers in the world already in their pocket, that number could massively spike the company’s top line.

That’s just one reason we’re convinced investing in this under-the-radar stock could prove to be highly lucrative — given 5G’s enormous potential.

Now, I don’t like to brag… but here at Motley Fool UK, we’ve had a pretty good track record of picking trends before they get big.

In fact, since the service launched in February 2012, our average recommendation has returned 30.98% — beating the market by 0.03 percentage points!1

So, as I see it, there’s just one problem…

You need to get in before the crowd catches onto this ‘sleeping giant’.

Just enter your email address below to discover how you can get the full scoop on this immense 5G opportunity now.

The Motley Fool places a cookie on your device for record keeping purposes. For more information, please see our Privacy Statement and Terms & Conditions.

Small Print

-

- Motley Fool Share Advisor has delivered an overall return of 38.6%. The S&P UK Broad Market index has delivered an overall return of 17.4%. Returns are calculated using a time-weighted rate of return (TWRR) methodology that includes dividends reinvested and excludes trading costs. The returns on investments made in overseas currencies are calculated without adjusting for changes in exchange rates, so these may not accurately reflect actual returns for a sterling-based UK investor. The S&P UK Broad Market returns include dividends reinvested. Returns are measured from the date of each recommendation to the close of trading on 30/06/2021. 2 recommendations per month have been made since 27/02/2012.