The stock market has been choppy for a good few weeks. So now seems like an opportune time to be investing for the long term. Here’s two fantastic shares I’d buy today if I were starting to build a £20k Stocks and Shares ISA.

Swag bag enabler

Millions of new businesses are started in the UK and US every year. Many of them will need to emboss their company name and logo onto everyday items. That might be uniforms, pens, bags, mugs, golf balls, menu chalkboards, and much more.

This niche market can be big business when done at scale. And that’s what 4imprint (LSE: FOUR) is finding as it has become the world’s largest promotional products group.

It sells millions of items online across the UK, Ireland, and North America. And in 2022, its revenue surged past the $1bn mark for the first time. Meanwhile, profits more than tripled to $103m as it added 307,000 new customers during the year.

This growing scale is driving a noticeable increase in its operating margin, which has climbed from 6.3% in 2019 to 9% today.

This week, the firm announced that business has started strongly in the first four months of 2023, though management is cautious for the rest of the year with a US recession still possible. The potential for an economic downturn remains a risk and the shares have consequently fallen 11.5% since March.

This leaves the FTSE 250 stock on a price-to-earnings (P/E) ratio of 19.5. For me, that looks great value for a company posting strong double-digit sales growth. Especially when some FTSE 100 stocks are growing in the low single digits and commanding a higher valuation.

As such, I’ve added 4imprint shares to my buy list for June.

Cheap high-yield stock

Next, I’d go for income, and specifically insurer and asset manager Legal & General (LSE: LGEN).

The stock is down 13% since the banking crisis started to unfold in March, seemingly on fears around its annuity bond portfolio. It also has significant exposure to real estate assets and obviously there has been stress recently in property markets.

L&G has a vast amount of assets under management and it’s very hard to get a grip on the potential risks here. The pace of interest rate rises has caught many off guard. But evaluating and quantifying risk is something the business has been doing for nearly 200 years, and it has a credit default reserve of £2.2bn.

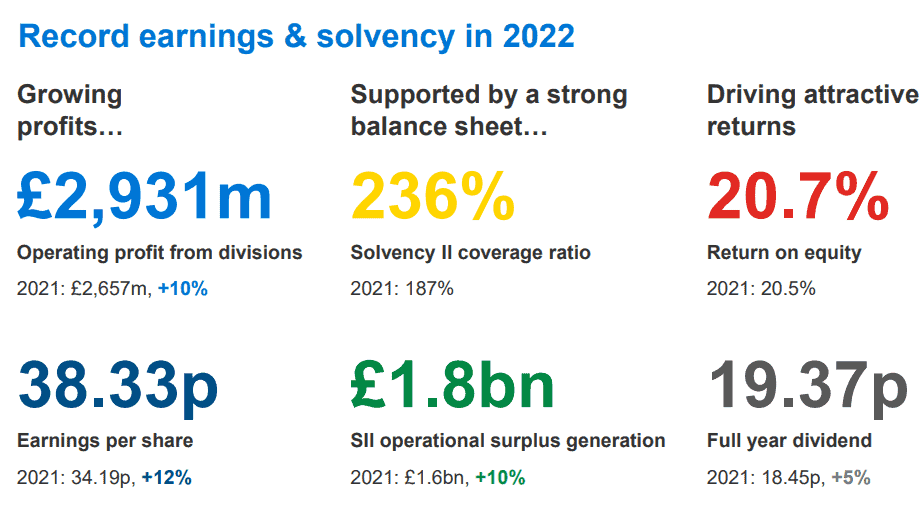

Plus, its latest full-year results appeared solid to me, as evidenced by the numbers below.

Share price weakness has pushed the dividend yield to 8.4%. No payout is ever guaranteed, of course, but I’m reassured that the dividend appears sufficiently well covered by earnings.

Further, management is committed to increasing the dividend per share by 5% out to 2024. And the stock now has a P/E of just 6.2, so there seems to be some margin of safety here.

Looking forward, the group has major expansion plans in Asia, where it intends to build on the $150bn of regional assets already under management.

I consider this stock a steal at today’s price. In fact, it’s a bargain I couldn’t pass up as I recently added to my own holding.