Warren Buffett is a legendary figure in investing circles. His value investment philosophy has made him the world’s fifth-richest person via Berkshire Hathaway with a $108bn net worth. Accordingly, I think it’s worth looking at Berkshire’s stock market positions as inspiration for my own portfolio.

One stock stands out thanks to its 60-year dividend growth streak. Boasting a stellar passive income record and dividend aristocrat status, I think this company could help me build wealth over the long term.

The dividend stock I’m referring to is Coca-Cola (NYSE:KO).

Warren Buffett’s fifth-largest holding

Buffett first acquired Coca-Cola stock in 1988. Today, it’s Berkshire’s fifth-largest position at nearly 7% of the portfolio. Buffett’s company owns 400m shares in the drinks giant, which equates to 9.2% of all outstanding Coca-Cola shares.

It’s featured constantly in Berkshire’s portfolio for 35 years. Based solely on its dividend income, Buffett’s Coca-Cola shareholding returns double the billionaire’s initial investment every two years.

Today, the stock offers a 2.95% dividend yield.

Positive financials

The Coca-Cola Company is 131 years old. It’s the most valuable drinks brand globally with an instant recognition factor in almost every country. Remarkably, 2.1bn servings of Coke products are consumed worldwide every day.

Turning to the Q3 2022 results, there’s much to cheer. The business delivered 10% net revenue growth to $11.1bn and earnings per share (EPS) increased 14% to $0.65.

In addition, a 27.1% free cash flow margin bodes well for continued dividend strength.

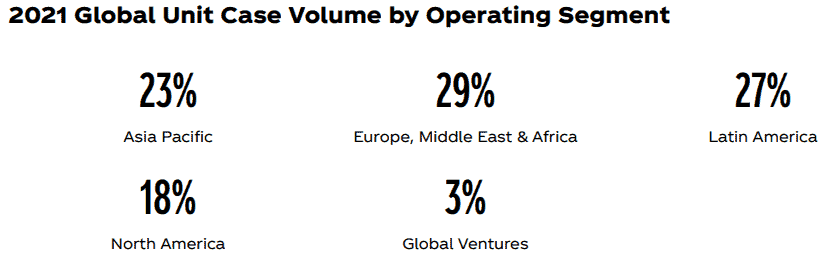

I also like the diverse geographic footprint. Coca-Cola sells beverages on every continent and, as a result, it’s not too reliant on any single region to generate revenue.

Valuing the stock

Coca-Cola’s price-to-earnings ratio is above 26. That’s higher than its long-term average and there’s a risk the share price and income growth outlook isn’t particularly exciting at today’s valuation.

Nonetheless, Buffett bought Coca-Cola shares at an average price of 15 times EPS in 1988. Granted, that’s below today’s multiple. However, the purchase came after the 1987 stock market crash.

In that context, it’s notable that this wasn’t a deep value stock like so many of the investor’s transactions over the years.

This reminds me of a memorable Buffett quote.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Berkshire Hathaway Chairman’s Letter 1989

With strong pricing power and a competitive advantage, I believe Coca-Cola’s a great defensive stock to buy, even at today’s valuation.

My portfolio

I own Coca-Cola shares in my diversified portfolio. I plan to hold them for a long time, exactly like Warren Buffett.

The company delivered an 8.75% compound annual total return over the past 20 years. It’s also upgraded its EPS and revenue growth expectations to 6-7% and 14-15% respectively for 2022, which suggests a bright outlook.

Due to its resilient business model, I think there’s every reason Coca-Cola can continue to deliver good returns (although there’s a risk it could underperform).

For instance, let’s imagine it replicated its 8.75% annual growth rate over the next 35 years. An initial £53,500 investment would eventually balloon to over £1m!

I don’t have enough spare cash to invest that amount currently. Nonetheless, I’ll continue to buy the shares regularly over the coming years to build long-term wealth.